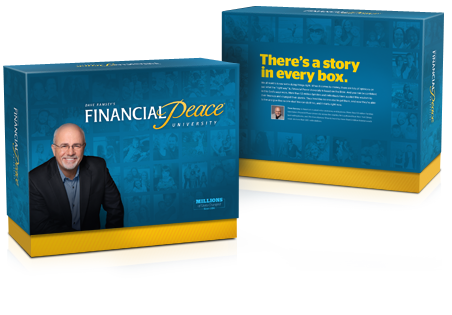

Dave Ramsey's Financial Peace University

|

We all need a plan for our money. Financial Peace University (FPU) is that plan! It teaches God's ways of handling money. Through video teaching, class discussions and interactive small group activities, FPU presents biblical, practical steps to get from where you are to where you've dreamed you could be. FPU will show you how to get rid of debt, manage your money, spend and save wisely, and much more!

Within the first 90 days of Dave's most popular class, the average family pays off $5,300 in debt and saves $2,700. These nine lessons (formally 13) will teach you to get out of debt the same way you learned to walk, one step at a time. The Bible is filled with practical and relevant wisdom on saving, spending, debt and even investing. So much in fact, if you counted the verses, the bible says more about money than love. Whether you are well-off or struggling, Financial Peace University will unpack how these timeless truths apply to your life, today. Find a class in your area today. |

Video: Dave Ramsey Financial Peace Highlights

What will you learn?

Financial Peace University (FPU) is a nine-week class on money taught on video by America's most trusted financial guru, Dave Ramsey. You will learn the basics of budgeting, dumping debt, planning for the future, and much more! The nine weeks can be broken down into the following nine lessons.

Lesson 1 - Super Saving

Common Sense for Your Dollars and Cents Dave explains the seven Baby Steps that will guide you throughout Financial Peace University. You will also learn the three key reasons why you should save money - and why you must start now!

Lesson 2 - Relating With Money

Nerds and Free Spirits Unite! Learn why it's important for spouses to communicate and work together toward success. Also, singles will learn the importance of accountability, and parents will find out how to teach their kids about money.

Lesson 3 - Cash Flow Planning

The Nuts and Bolts of Budgeting Learning how to take control of your money starts with a budget. Unlock the secret of developing a monthly spending plan that really works.

Lesson 4 - Dumping Debt

Breaking the Chains of Debt It's time to debunk some common debt myths! Dave reveals the truth about credit lies and gives you a plan to walk out of debt with confidence.

Lesson 5 - Buyer Beware

The Power of Marketing on Your Buying Decisions Dave draws on decades of experience to reveal the power and influence that marketing has on your everyday buying decisions.

Lesson 6 - The Role of Insurance

Protecting Your Health, Family and Finances In this lesson, Dave walks you through the world of insurance, carefully explaining what you need—and what you need to avoid.

Lesson 7 - Retirement and College Planning

Mastering the Alphabet Soup of Investing Dave walks you through the maze of retirement options and helps you figure out your best retirement plan. You will also learn how to plan for college so your kids can graduate debt free!

Lesson 8 - Real Estate and Mortgages

Keeping the American Dream From Becoming a Nightmare Dave draws on more than 20 years of real estate experience to teach you the ins and outs of mortgages and how to win when buying or selling your home.

Lesson 9 - The Great Misunderstanding

Unleashing the Power of Generous Giving Learn how generous giving can completely revolutionize your attitude and improve your finances, business and relationships.

Lesson 1 - Super Saving

Common Sense for Your Dollars and Cents Dave explains the seven Baby Steps that will guide you throughout Financial Peace University. You will also learn the three key reasons why you should save money - and why you must start now!

Lesson 2 - Relating With Money

Nerds and Free Spirits Unite! Learn why it's important for spouses to communicate and work together toward success. Also, singles will learn the importance of accountability, and parents will find out how to teach their kids about money.

Lesson 3 - Cash Flow Planning

The Nuts and Bolts of Budgeting Learning how to take control of your money starts with a budget. Unlock the secret of developing a monthly spending plan that really works.

Lesson 4 - Dumping Debt

Breaking the Chains of Debt It's time to debunk some common debt myths! Dave reveals the truth about credit lies and gives you a plan to walk out of debt with confidence.

Lesson 5 - Buyer Beware

The Power of Marketing on Your Buying Decisions Dave draws on decades of experience to reveal the power and influence that marketing has on your everyday buying decisions.

Lesson 6 - The Role of Insurance

Protecting Your Health, Family and Finances In this lesson, Dave walks you through the world of insurance, carefully explaining what you need—and what you need to avoid.

Lesson 7 - Retirement and College Planning

Mastering the Alphabet Soup of Investing Dave walks you through the maze of retirement options and helps you figure out your best retirement plan. You will also learn how to plan for college so your kids can graduate debt free!

Lesson 8 - Real Estate and Mortgages

Keeping the American Dream From Becoming a Nightmare Dave draws on more than 20 years of real estate experience to teach you the ins and outs of mortgages and how to win when buying or selling your home.

Lesson 9 - The Great Misunderstanding

Unleashing the Power of Generous Giving Learn how generous giving can completely revolutionize your attitude and improve your finances, business and relationships.